Investing in stocks might sound intimidating, especially when you’re thinking about playing the long game. But here’s the truth: long-term stock investments are one of the best ways to grow your money in the USA. Whether you’re saving for retirement, your kid’s college fund, or simply building wealth, this guide will walk you through everything you need to know—without all the boring financial jargon.

What Are Long-Term Stock Investments?

Before diving in, let’s clear up what we mean by “long-term.” Long-term investing typically refers to holding onto your stocks for years—think five, ten, or even twenty years. The idea is to ride out the ups and downs of the stock market and let your investments grow over time.

Unlike day trading (which is all about quick buys and sells), long-term investing focuses on patience. You’re betting on the future success of companies, industries, and the economy as a whole.

Why Should You Go Long-Term?

Here are a few solid reasons why long-term stock investing might be your best bet:

- Compound Growth is Your Best Friend

Ever heard of compound interest? It’s the magic of earning returns on your returns. When you reinvest your earnings, your money snowballs over time. - Avoid Market Drama

The stock market can be a rollercoaster. One day it’s up, the next day it’s down. But history shows that the market tends to recover and grow over the long haul. - Lower Taxes and Fees

Long-term capital gains (profits from selling stocks after holding them for over a year) are taxed at a lower rate compared to short-term trades. That means more money stays in your pocket. - Sleep Easy at Night

Unlike short-term trading, you don’t have to stress over daily price changes or sudden crashes. Long-term investors can simply ignore the noise.

The Best Long-Term Stocks in the USA

When it comes to long-term investments, not all stocks are created equal. Here are some categories of stocks that tend to perform well over time:

1. Blue-Chip Stocks

Blue-chip stocks are shares in large, well-established companies with a history of steady performance. Think of them as the “safe bets” of the stock market.

Examples:

- Apple (AAPL)

- Microsoft (MSFT)

- Coca-Cola (KO)

2. Dividend Stocks

Dividend stocks pay you a portion of the company’s profits regularly. It’s like getting a paycheck just for owning the stock.

Examples:

- Johnson & Johnson (JNJ)

- Procter & Gamble (PG)

- AT&T (T)

3. Growth Stocks

Growth stocks are companies expected to grow faster than the overall market. These don’t usually pay dividends but can skyrocket in value over time.

Examples:

- Tesla (TSLA)

- Amazon (AMZN)

- Nvidia (NVDA)

4. Index Funds and ETFs

If picking individual stocks feels overwhelming, index funds and ETFs (exchange-traded funds) are fantastic options. These are bundles of stocks that track an index like the S&P 500.

Examples:

- Vanguard S&P 500 ETF (VOO)

- SPDR Dow Jones Industrial Average ETF (DIA)

How to Get Started with Long-Term Investing

Alright, now let’s talk about how you can jump into long-term investing without breaking a sweat.

1. Set Your Goals

Why are you investing? Is it for retirement, a dream house, or your child’s education? Knowing your goals will help you determine how much risk you can take.

2. Build a Budget

Decide how much you can invest each month. Even $50 a month can grow into something big over time.

3. Choose a Brokerage

To buy stocks, you’ll need a brokerage account. Some popular options in the USA include:

- Robinhood: Great for beginners with zero commission fees.

- Fidelity: A solid all-around platform.

- Vanguard: Known for low-cost index funds.

4. Start Small

You don’t need to be rich to start investing. Thanks to fractional shares, you can buy a small slice of expensive stocks like Amazon or Tesla.

5. Diversify Your Portfolio

Don’t put all your money in one stock or sector. Spread your investments across different industries to reduce risk.

6. Stay Consistent

Make investing a habit. Whether it’s monthly, quarterly, or annually, stick to a schedule.

7. Ignore the Noise

Market dips are normal. The key is not to panic and sell when prices drop. Remember, you’re in it for the long haul.

Common Mistakes to Avoid

Here are a few pitfalls to watch out for as a long-term investor:

- Timing the Market

No one can predict the perfect time to buy or sell stocks. Focus on time in the market, not timing the market. - Following the Hype

Just because everyone is buying a stock doesn’t mean you should. Do your own research. - Ignoring Fees

Some platforms and funds come with high fees that can eat into your profits. Look for low-cost options. - Selling Too Soon

Selling out of fear during a market dip is one of the biggest mistakes you can make. Stay patient!

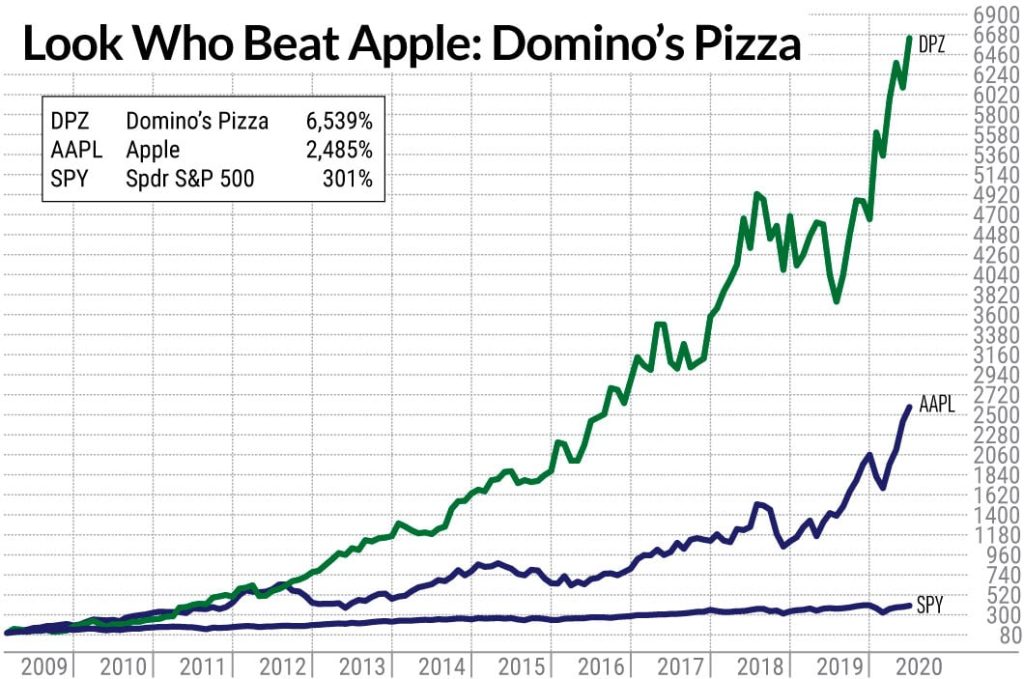

The Power of Historical Data

If you’re still skeptical, let’s take a quick look at history. The S&P 500, which tracks the performance of 500 major companies in the USA, has delivered an average annual return of about 8-10% over the past century. Even after accounting for market crashes, wars, and recessions, it has continued to grow over the long term.

FAQs About Long-Term Stock Investments

1. How much money do I need to start?

You can start with as little as $1, thanks to fractional shares. It’s more about consistency than the amount.

2. How do I know which stocks to pick?

Look for companies with strong financials, a history of growth, and a competitive edge in their industry.

3. What’s the biggest risk of long-term investing?

The main risk is not diversifying enough. If you put all your money in one stock and it tanks, you’re out of luck.

4. Can I lose all my money?

It’s unlikely if you diversify and stick to well-established companies or funds. The market has always rebounded over time.

5. Do I need to keep checking my portfolio?

Not really. Checking it once or twice a year is enough to ensure everything is on track.

Resources to Help You on Your Journey

Starting with long-term investing doesn’t mean you have to figure everything out on your own. Here are some resources to help you make informed decisions and stay motivated:

1. Investment Books

- The Intelligent Investor by Benjamin Graham: A classic that teaches the principles of value investing.

- Common Stocks and Uncommon Profits by Philip Fisher: Focuses on finding high-quality growth stocks.

- Rich Dad Poor Dad by Robert Kiyosaki: While not specifically about stocks, it’s great for understanding financial literacy.

2. Financial Websites and Tools

- Yahoo Finance: Stay updated on stock news and market trends.

- Morningstar: Provides detailed stock and fund analysis.

- Seeking Alpha: A great platform for investor opinions and insights.

3. Apps for Beginner Investors

- Robinhood: Beginner-friendly with commission-free trades.

- Acorns: Automatically invests your spare change.

- Stash: Offers investment advice and beginner education.

4. Podcasts and YouTube Channels

- The Motley Fool Podcast: Easy-to-understand advice for all investors.

- The Investor’s Podcast: Focused on stock market strategies.

- YouTube Channels: Graham Stephan, Andrei Jikh, or Meet Kevin.

The Patience Game: Stay the Course

One of the hardest parts of long-term investing is staying patient. The stock market won’t make you a millionaire overnight. There will be times when it feels like your portfolio isn’t moving at all—or worse, it’s losing value. This is where your mindset matters most.

Here’s how to keep your cool:

- Remember Your Why: Go back to your investment goals and remind yourself why you started.

- Focus on the Big Picture: Short-term market swings don’t matter when you’re investing for decades.

- Trust Historical Trends: The market has always bounced back from downturns, even during major crises.

- Avoid Checking Daily: Constantly monitoring your portfolio can lead to emotional decisions. Set it and forget it.

A Quick Recap for Beginners

If you’re feeling overwhelmed, here’s a simple checklist to get started with long-term investing:

- Set clear financial goals.

- Open a brokerage account with a trusted platform.

- Start small, even with just $10 or $50.

- Pick a mix of blue-chip stocks, ETFs, and growth stocks.

- Stay consistent—invest regularly, no matter what.

- Reinvest your earnings to maximize compound growth.

- Don’t panic during market dips. Stay the course.

Your Future Self Will Thank You

Think about where you want to be in 10, 20, or even 30 years. Long-term stock investing is one of the best ways to secure your financial future. The sooner you start, the more time your money has to grow. Whether you’re planning for retirement, a big life goal, or just building a cushion of wealth, your commitment today will pay off massively down the road.

So, don’t wait for the “perfect time” to start investing—because it doesn’t exist. The best time to plant a tree was 20 years ago. The second-best time? Right now. Open that brokerage account, start small, and let time do the heavy lifting for you. The journey to financial freedom begins with a single step. Take it today!

Final Thoughts

Long-term investing in the USA is one of the smartest ways to build wealth. It’s not about getting rich quickly but growing your money steadily over time. With a little patience, discipline, and smart choices, your future self will thank you for starting today.

So, what are you waiting for? Open that brokerage account, pick your first stock or fund, and take the first step toward financial freedom!