A note for my friends in Jakarta and across Southeast Asia: As the US market closed for the week in the wee hours of Saturday morning your time, you’re probably just waking up, grabbing your coffee, and wondering, “So, what on earth just happened?” Don’t worry, I stayed up and watched the whole crazy show for you. Let’s break it down.

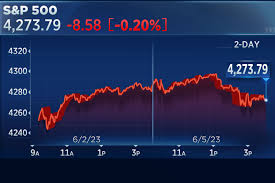

So, how was your week? Relaxing? I hope so, because Wall Street just went through the financial equivalent of a five-day, high-intensity interval training workout. If you took a quick glance at the S&P 500’s final number for the week – finishing up a respectable 1.2% – you might just shrug and think, “Not bad, pretty standard.”

But oh, my friend, that final number is a complete liar. It’s like seeing a picture of a friend smiling at the finish line of a marathon without seeing the 42 kilometers of pain, sweat, and existential crisis they went through to get there. This week was a chaotic, nail-biting, headline-jerking rollercoaster. We swung from optimism to flat-out panic and back again, sometimes within the same trading session.

The main story, the big boss battle of the week, was a three-headed monster: a crucial inflation report, a surprise monologue from the big man at the Federal Reserve, and a nail-biter of an earnings report from the most valuable company on the planet.

So grab your drink, get comfortable, and let’s spill the tea on the week that was.

The Calm Before the Storm: Monday and Tuesday’s Anxious Sidestep

The week kicked off not with a bang, but with a weird, nervous silence. The market was basically doing that awkward shuffle you do when you’re waiting for an elevator, not wanting to make eye contact with anyone. Traders were just pushing stocks around in small circles, like a kid moving peas around their plate. The S&P 500 barely budged, hovering around the 5,300 mark like a nervous drone.

Why the anxiety? Everyone was holding their breath for Wednesday morning in the US. That was when we were scheduled to get the PCE inflation report.

Now, I know, another inflation report. Yawn. But this one is different. While the CPI (Consumer Price Index) gets all the media attention, the PCE, or Personal Consumption Expenditures price index, is the one Federal Reserve Chair Jerome Powell and his crew watch like a hawk. It’s their favorite. Think of it this way: the CPI is the blockbuster action movie with lots of explosions, but the PCE is the thoughtful indie film that the critics (the Fed) actually care about.

So, the entire market was on pause, waiting to see if this number would be hot, cold, or just right. A hot number would mean the Fed might have to raise interest rates again (bad for stocks). A cold number would mean they could start thinking about cutting rates (very good for stocks).

Adding a little spice to this waiting game was Amazon ($AMZN), which reported its earnings after the bell on Tuesday. The result was… confusing. A classic mixed bag. Their online retail business looked surprisingly strong – people were still clicking “Buy Now” like there was no tomorrow. But the real engine of their profit, Amazon Web Services (AWS), their cloud computing division, showed a bit of a slowdown. It wasn’t a disaster, but it wasn’t the stellar, world-beating growth everyone had gotten used to.

This sent a shiver through the tech sector. If even the mighty AWS was feeling a pinch, what did that mean for everyone else? It was the first little crack in the market’s armor, and it set a very nervous tone heading into Wednesday’s main event.

Wednesday’s Whiplash: Good News, Bad News, and a Whole Lot of Confusion

Wednesday morning, around 7:30 PM Jakarta time, the PCE numbers dropped. And for about five glorious minutes, it looked like we had a party on our hands.

The main number, the “headline” PCE, came in a little lower than expected. Inflation was cooling! The market futures instantly shot up. You could almost hear the champagne corks popping on Wall Street.

But then, everyone read the fine print.

The “core” PCE number – which strips out the wild swings of food and energy prices – was actually a tiny bit higher than forecasted. It was what we call “sticky.” It just wouldn’t go down.

Imagine going to the doctor. The doctor says, “Great news! Your overall health is improving!” You cheer. Then he leans in and whispers, “…but that one specific, really important artery is still kind of clogged.” That’s what this report felt like.

The market’s reaction was instantaneous and brutal. That initial pop vanished in seconds, replaced by a sea of red. The S&P 500, which had been flirting with a breakout, suddenly tumbled. The dream of Fed rate cuts in 2025 seemed to evaporate right before our eyes. The optimistic buzz from the start of the day was replaced with a sinking feeling of, “Oh great, so we’re stuck in this high-interest-rate mud for even longer.”

Compounding this misery was the hangover from Amazon’s AWS numbers. Tech stocks, which are super sensitive to interest rate fears, led the charge downwards. It was a classic one-two punch: disappointment in big tech, followed by a gut-punch from the inflation data. By midday in New York, the mood was sour. It felt like the bears were getting ready to feast.

Thursday’s Twin Pillars: The Prophet Powell and the Apple Miracle

Just when we thought the week’s drama was over, Thursday decided to yell, “Hold my beer.”

First, out of nowhere, the Federal Reserve announced that Chairman Powell would be giving an “unscheduled speech” at an economic symposium. My heart sank. Unscheduled speeches from a Fed Chair are almost never good news. It’s like your boss calling a “quick, unscheduled meeting” on a Friday afternoon. It usually means something is wrong.

And for a while, it seemed that way. Powell got up on stage and did his classic Powell thing: he spoke in a calm, reassuring tone while simultaneously saying things that could be interpreted in a hundred different ways. He said the Fed was pleased with the progress on headline inflation, but that they remained “resolute” in their fight against the “stubbornness” in core services inflation. He basically gave the market a pat on the head and a slap on the wrist at the same time.

He used the phrase “data-dependent” about a dozen times, which is Fed-speak for “We have no idea what we’re going to do next, so please stop asking.” The market didn’t like the uncertainty. The S&P 500 wobbled and dipped again. The bears were licking their chops. It felt like the week was destined to end on a low note.

And then… after the market closed on Thursday… Apple ($AAPL) reported its earnings.

And it wasn’t just good. It was a miracle.

In a week filled with anxiety about the economy and inflation, Apple stepped up and showed the world that people will still crawl over broken glass to buy a new iPhone. Their sales numbers blew past expectations, especially in emerging markets across Asia, which should make all of us here feel like we personally contributed to their success.

But the real showstopper was Tim Cook’s commentary on their AI strategy. He finally gave some concrete details about how their new line of AI-powered features would be integrated into the next iOS, promising things that actually sounded useful and not just gimmicky. He painted a picture of an Apple that was not just a hardware company, but a dominant force in personal artificial intelligence.

Wall Street went absolutely wild. Apple’s stock soared in after-hours trading, pulling the entire tech sector up with it. It was like a giant defibrillator shock to the heart of the market. The entire narrative of the week shifted in an instant. Suddenly, we weren’t talking about sticky inflation anymore. We were talking about innovation, massive profits, and the unstoppable power of Big Tech.

Friday’s Grand Finale: The Goldilocks Rally

After the emotional fireworks of Thursday, Friday could have gone either way. But we had one more massive piece of data to get through: the monthly US jobs report.

This is always a huge market-mover. A report that’s too hot (too many jobs created) would spook the Fed into thinking the economy is overheating, leading to rate hike fears. A report that’s too cold (job losses) would signal a recession is coming.

What we all desperately wanted was a “Goldilocks” report. Not too hot, not too cold, but just right.

And for the first time all week, we actually got it. The report showed that the US economy added a healthy number of jobs – enough to show that things are still growing and people are employed – but wage growth was moderate. It was the perfect, non-controversial, calming number the market was begging for.

The relief was palpable.

Combined with the euphoric afterglow from Apple’s earnings, this Goldilocks jobs report was the fuel the market needed for a spectacular grand finale. From the opening bell on Friday, it was all green. The S&P 500 surged, erasing all the losses from Wednesday and Thursday and then some. It was a powerful, broad-based rally that lifted almost every sector.

The week that started with a whimper and nearly fell off a cliff mid-way ended with a triumphant roar.

A Quick Look Under the Hood: Sector Winners and Losers

If we pop the hood on the S&P 500, we can see who really won and lost this week.

- The Big Winners: No surprise here, it was the Technology Sector ($XLK) and especially the Semiconductors ($SOXX). Apple’s incredible report acted like a rising tide that lifted all tech boats. Chipmakers like Nvidia and AMD had a fantastic end to the week, riding on the coattails of Apple’s success and the renewed faith in a tech-driven future.

- The Big Losers: Energy stocks ($XLE) had a rough time. Oil prices dipped this week on concerns that a global economic slowdown might curb demand, and that dragged down the shares of giants like ExxonMobil and Chevron.

- The Confused Middle Child: Consumer Discretionary ($XLY), the sector that includes companies like Amazon and Tesla, was all over the place. Amazon’s strong retail numbers were a plus, but fears about how inflation might impact consumer spending on non-essential items kept a lid on the sector’s performance.

The View from Jakarta: So What Does This All Mean?

Phew. Take a breath. That was a lot.

So, sitting here in Jakarta, watching this all unfold on your phone late at night, what’s the main takeaway?

The biggest lesson from this week is that the market is currently in a tense tug-of-war. In one corner, you have the “macro” story: fears about inflation and what the Federal Reserve will do next. In the other corner, you have the “micro” story: the actual performance of individual companies.

This week, the micro story won. The sheer fundamental power and profitability of a company like Apple were enough to make everyone temporarily forget their fears about interest rates. It’s a powerful reminder that even in a confusing economic environment, strong companies with great products can still thrive.

For a long-term investor, this week was mostly noise. It’s a perfect example of why you shouldn’t panic-sell when the headlines are scary on a Wednesday, because the entire story can change by Friday. The strategy of steadily investing in a diversified portfolio of great companies and ETFs, regardless of the weekly drama, remains undefeated.

Looking ahead, we’ll be watching to see if other companies can continue this trend of strong earnings. We’ll also be listening for any more whispers from Fed officials. But for now, the market is breathing a sigh of relief.

Alright, that’s the wrap. It was a wild ride, but we made it through. Now go and enjoy your Sunday. You’ve earned it.

Until next week, stay patient and keep your eye on the long game.